What Apple’s Second Payment Service Directive PSD2 notification means to you?

Last weekend, Apple sent a notice about the Payment Service Directive (PSD2) implemented by the App Store and iTunes. But what is the second payment service instruction? How does it affect your future purchases? Is Apple Pay compatible? Keep reading and understand what the new instruction means to you and how it will change your payment method.

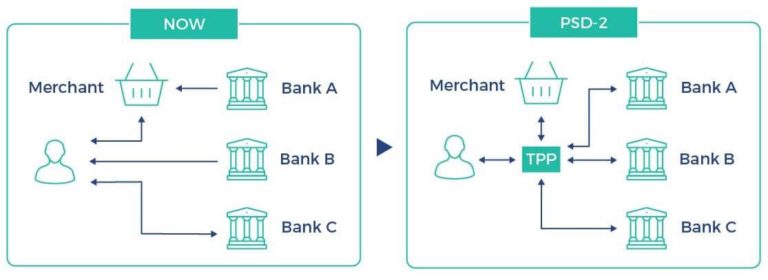

PSD2 is new compliance announced by the European Union to make financial services more accessible. Currently, banks and other financial institutions maintain customer accounts. These institutions are called Account Service Payment Service Providers (ASPSP). ASPSP should provide third-party payment providers (TPP) with a secure way to access customer information.

PSD2 introduces two new TPP categories-AISP, and PISP-EU banks and fintech companies can use them. AISP allows third-party services to securely view the customer’s bank account information, of course, after the user agrees to the third-party service. Take it with us! Second, PISP allows third-party services to make payments without accessing customers’ private information (bank account numbers or credit card numbers).

However, as accessibility improves, the amount of fraud may increase. To prevent this, PSD2 also introduces many security features that make online purchases safer. OAuth 2.0, OpenID, etc., require the introduction of strong customer authentication (SCA) in transactions to protect users from online fraud. This means that whenever an app, website, or App Store tries to charge you for a service, the transaction must be authenticated by other factors, such as a card PIN, one-time password (OTP), or fingerprint/face authentication.

In a recent email sent by Apple, Apple stated that Apple Pay is compatible with PSD2. Since Apple Pay has a multi-factor authentication system—Apple Pay transactions are authenticated through face ID or touch ID—it complies with PSD2 and SCA.

Apple says that from now on, many purchases on the App Store may require “an additional verification step at checkout.” Suppose you don’t use Apple Pay. Well, if you already use Apple Pay, you don’t need to worry.

For users who set up Apple Pay on iPhone, Apple has set Apple Pay as the default payment method because it already complies with SCA and PSD2. Apple highlighted specific scenarios that may require SCA authentication, even when using Apple Pay.

· For auto-renewing subscriptions, SCA is only required for the first transaction.

· SCA may not be required for purchases under 30 Euros.

· Purchases made with Apple Pay that have met the SCA requirements do not require additional authentication.

· Purchases made using cell phone bills, other payment services, or Apple ID balances (from gift cards or top-ups) do not require additional authentication.

If you want to change in preferred payment method from Apple Pay to another method, such as your credit card or your carrier, But remember, you must authenticate each transaction via OTP or web-pin.